Are honorarium taxable in India?

An honorarium is a payment given for services done willingly, often for a special event or project. Think of it as a thank-you gift for your expertise and time. Since you’re receiving money for your work, it’s considered income and is subject to income tax in India.

Here’s why:

It’s Income: The Income Tax Department considers honorariums as income from other sources. This means it falls under the tax net and you’ll need to declare it when filing your tax return.

No Formal Contract:Honorariums are usually given without a formal employment contract, but that doesn’t exempt them from taxes. The tax rules are based on the nature of the payment, not the type of arrangement.

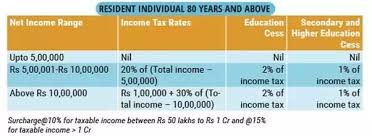

Tax Liability: The tax liability on your honorarium will depend on your total income for the year. If your income is within the tax-free limit, you won’t have to pay any taxes on the honorarium. However, if your total income exceeds the tax-free limit, the honorarium will be added to your taxable income, and you’ll need to pay taxes on it according to the applicable tax slab rates.

It’s always a good idea to consult a tax professional or financial advisor for personalized guidance on your specific situation. They can help you understand the tax implications of honorariums and ensure you’re following the correct procedures for reporting and paying taxes on them.

How much is the honorarium payment?

* For judging a writing or photo contest, a $50-$150 honorarium is common, plus any travel costs. This range reflects the time commitment involved in reviewing entries and selecting winners.

* If you’re invited to participate in a panel discussion, a $500-$750 honorarium is a good starting point, plus any travel costs. This recognizes the preparation time, research, and presentation skills needed for a successful panel.

Understanding Honorarium Payments:

There’s no fixed rule for honorarium amounts. The ideal honorarium is determined by several factors, including:

* The prestige of the event: A high-profile conference or competition might offer a larger honorarium than a smaller, local event.

* The time commitment: A multi-day event requiring extensive preparation will likely command a higher honorarium than a short, one-time presentation.

* Your experience and expertise: Recognized experts or individuals with significant experience in the field may receive a higher honorarium.

* The organization’s budget: Some organizations have limited budgets and may offer a smaller honorarium.

Negotiating an Honorarium:

Don’t be afraid to negotiate a fair honorarium. It’s perfectly acceptable to discuss your expectations with the organizers. Be prepared to explain your reasoning and highlight your contributions to the event.

Remember: An honorarium is a gesture of appreciation and should reflect the value you bring to the event. It’s a chance to be compensated for your time and expertise while contributing to something meaningful.

What is the GST rate for freight charges 18?

The HSN code for freight charges is 9965 and the GST rate is 18%. This applies to inward, outward, and forwarding charges. However, the SAC code can be further classified depending on the specific type of freight.

The SAC code uses two additional digits as a suffix to further categorize different types of freight charges. For example, the SAC code for air freight charges is 996511, while sea freight charges are categorized under 996512, and road freight charges under 996513. This detailed classification helps ensure accurate GST calculation for various freight services.

Important note: It is crucial to remember that this general information about GST rates and HSN/SAC codes for freight charges is a good starting point. Always refer to the latest GST rules and regulations to confirm the applicable GST rate for your specific situation.

Why is it important to understand SAC codes?

Accurate GST Calculation: The SAC code plays a critical role in determining the correct GST rate for your freight charges. This ensures you pay the right amount of tax and avoid any penalties.

Clear Documentation: Having a clear understanding of the SAC code for your specific freight type helps you maintain accurate records for tax purposes. This documentation can come in handy during audits or other official inquiries.

GST Compliance: By using the correct SAC code, you demonstrate your adherence to GST guidelines. This helps maintain a good compliance record, preventing any unnecessary issues or penalties.

Understanding the HSN code and the finer details of SAC codes within the context of freight charges is crucial for both businesses and individuals involved in the transport and logistics industry. These codes, along with their associated GST rates, help ensure a streamlined and compliant process for all stakeholders.

What is the difference between honoraria and honorarium?

But don’t worry, you’re not alone in wondering about the difference. Many words that come from Latin have their own unique plural forms. For example, the plural of stadium is stadia.

Let’s talk about why honoraria is the correct plural. You see, honorarium comes from the Latin word honorarium, which itself is a noun derived from the adjective honorarius. Latin nouns ending in -ium have the plural form -ia, hence honoraria.

The same rule applies to other words like curriculum, which has a plural of curricula. So, the next time someone asks you about the plural of honorarium, you can confidently answer: honoraria!

What money is not taxable in India?

Agricultural income – This income is specifically exempt from taxation, which helps support farmers and agricultural activities.

Gifts – Receiving gifts from loved ones is usually considered tax-free. There are some exceptions though. Keep an eye out for the Gift Tax laws.

Scholarships – This income is exempt from taxation as it is intended to support education.

Gratuity – This is a lump sum payment you receive after completing a certain number of years of service. This income is usually tax-free up to a certain limit.

Leave encashment – You may receive payment for unused leave when you leave your job. This is generally tax-free, up to a specific limit.

Shares from HUF/partnership firm – When you receive shares from a Hindu Undivided Family (HUF) or a partnership firm, it is usually tax-free.

Pension – Your pension income is generally tax-free, however, there might be some specific rules depending on the source of your pension.

Interest income – Some interest incomes are exempt from tax. However, it’s best to check with a tax advisor to understand the specifics.

Provident funds – The income you receive from your Provident Fund (PF) is generally tax-free when you withdraw it.

Life insurance policy maturity amount – The amount you receive when your life insurance policy matures is generally tax-free up to a certain limit.

Remember, while these sources of income are generally tax-free, it is important to stay informed about any changes in tax laws. Consulting with a tax advisor is always a good idea to ensure you are compliant with all applicable tax rules.

Let’s break down some of these concepts in more detail.

Agricultural Income:

This refers to income derived from farming activities. The Income Tax Act in India exempts this income from tax. Whether you are a small-scale farmer or a large-scale agricultural business, this exemption encourages agricultural productivity and supports the livelihoods of many individuals involved in this sector.

Gifts:

Receiving gifts is often a joyful experience, and in many cases, it is tax-free. However, there are a few specific scenarios to be aware of. The Gift Tax Act comes into play when the value of the gift exceeds a certain limit. This limit varies depending on the relationship between the giver and the receiver. For example, a gift from a close relative (like a parent or sibling) may be exempt from tax, but a gift from an unrelated individual could be subject to gift tax.

It is important to remember that these examples are just a general overview. The specific details of tax exemptions can vary based on individual circumstances. Therefore, it is always best to consult a tax professional for personalized advice.

What is the 9 5 6 rule?

Here’s what the 9 5 6 rule looks like in practice:

9 Days: A researcher can’t spend more than 9 days at any single institution on a project within a 6-month period. This is to prevent one institution from having too much control over the research.

5 Institutions: A researcher can’t receive honorariums or expense reimbursements from more than 5 institutions within a 6-month period. This helps to ensure that researchers are not beholden to any one institution and that their work is truly independent.

6 Months: This refers to the time period used to track the 9 days and 5 institutions limitations. It’s a rolling six-month period, meaning that the window is constantly shifting.

The 9 5 6 rule isn’t a hard and fast rule, but rather a set of guidelines meant to promote transparency and ethical conduct in research. Many institutions have their own policies regarding research ethics, and these policies often incorporate the principles of the 9 5 6 rule.

Let’s break down the rationale behind each component of the 9 5 6 rule to understand its importance:

9 Days: Limiting the time a researcher spends at any one institution prevents that institution from having undue influence on the research direction or findings. It also helps to ensure that the researcher doesn’t become too familiar with the culture or processes of one specific institution, potentially impacting their objectivity.

5 Institutions: Restricting the number of institutions providing financial support to a researcher helps minimize potential conflicts of interest. It prevents researchers from being overly reliant on a single institution or from feeling pressured to produce results that favor one sponsor over another.

6 Months: A six-month period is used as a reasonable timeframe to evaluate research activities. It’s a short enough period to monitor potential conflicts of interest and a long enough period to observe meaningful trends in research activity.

The 9 5 6 rule is a crucial component of maintaining ethical standards in research. By adhering to these guidelines, researchers can ensure that their work is independent, objective, and free from undue influence.

See more here: How Much Is The Honorarium Payment? | Gst On Honorarium Payments In India

Does GST apply on honorarium paid to guest anchors?

Sansad TV and other TV channels often invite guest anchors to participate in their shows and pay them a remuneration in the form of an honorarium. Let’s dive deeper into the specifics of this situation.

Determining GST Applicability:

The question of whether GST applies to the honorarium paid to guest anchors hinges on the nature of the services provided and the classification of the guest anchor.

Guest anchors typically contribute their expertise and insights to the show. This contribution can be considered a service provided by the guest anchor.

Here’s a breakdown of how GST applicability could be determined:

Nature of Services: If the guest anchor is providing a service that is considered “supply” as defined under the GST Act, then GST would likely be applicable.

Classification of Guest Anchor: The GST treatment also depends on whether the guest anchor is classified as an “individual” or a “business”.

Individual Guest Anchor: If the guest anchor is an individual providing services in their personal capacity, then GST may not be applicable if their income falls below the threshold limit for registration under GST.

Guest Anchor as a Business: If the guest anchor is a business providing services, then GST is likely applicable on the honorarium paid, assuming the business is registered under GST.

Additional Considerations:

Tax Deducted at Source (TDS): Even if GST is not applicable, TDS may be deducted from the honorarium paid to the guest anchor, depending on the TDS provisions applicable.

Specific State Rules: It is crucial to check the specific rules and regulations of the relevant state where the TV channel is located as these can impact GST applicability.

Professional Advice: For a definitive answer, seeking guidance from a GST expert is recommended. They can provide tailored advice based on the specific circumstances and ensure compliance with the applicable laws.

Does a journal pay honorarium under GST?

It’s a common situation: a Chartered Accountant (CA) writes an article for a journal and receives an honorarium for their contribution. The question is whether this honorarium is subject to Goods and Services Tax (GST).

Here’s the key point to consider: GST is applicable if the honorarium received is for a service rendered. If the CA’s main profession is CA, writing articles is likely considered a secondary activity.

Let’s delve deeper into the topic:

Determining GST Applicability

Here’s how you can figure out if GST applies to the honorarium paid to a CA for writing an article:

Is the article writing a “service”?: If the CA is providing a service, like research, writing, or editing, that is considered a service under GST laws.

Is the article writing the CA’s primary activity?: If the CA’s main profession is CA, writing articles is likely considered a secondary activity.

Is the CA registered under GST?: If the CA is registered under GST, they need to factor it into their calculations.

Important Considerations

There are several factors that can influence whether GST is applicable to the honorarium:

The nature of the article: If the article is purely opinion based or informative, it’s less likely to be considered a service. However, if it involves consultancy, advice, or technical expertise, it could be seen as a service.

The contract terms: The agreement between the journal and the author should clearly specify the nature of the work and any service elements involved.

GST regulations: The GST laws and regulations in the specific country or region may have specific interpretations regarding honorarium for writing.

Best Practices

Clear agreement: The journal and the author should have a clear agreement that specifies the nature of the work, payment terms, and any GST implications.

Professional advice: Consulting with a tax professional is always advisable to ensure compliance with GST regulations and understand the specific situation.

In Conclusion

While a journal paying honorarium for an article published is a common occurrence, whether GST applies depends on several factors, such as the nature of the article, the author’s primary profession, and the specific GST regulations in the jurisdiction. To ensure compliance, it’s crucial to have a clear agreement and seek professional advice when needed.

Are sitting fees subject to GST?

Think of it this way: When you pay a sitting fee, you’re essentially paying for a service. The person receiving the fee is providing their expertise and time as a director. Because GST applies to the supply of services, it’s very likely that it will also apply to sitting fees.

Here’s a bit more detail about why GST might apply to sitting fees:

The Nature of the Service: When a director is paid a sitting fee, they are effectively providing their professional services as a director to the company. This service could include attending board meetings, participating in decision-making, and providing their expertise.

Consideration for Services: A sitting fee is considered “consideration” for the services provided by the director. Since GST is charged on the supply of services, and sitting fees represent the consideration for those services, GST is likely to apply.

TDS and GST: It’s common for sitting fees to be subject to TDS under Section 194J of the Income Tax Act 1961. This signifies that the sitting fee is considered income from professional services, and it aligns with the general principle that services provided for a fee are subject to GST.

Remember: If you’re unsure about whether GST applies to a specific sitting fee, it’s best to consult a tax professional. They can help you understand the specific circumstances and determine the appropriate tax treatment for your situation.

Is honorarium a porfessional or technical fee?

An honorarium is a payment made as a token of appreciation or recognition for services rendered, often in the form of a gift or contribution. It’s not a standard fee for a specific service like a professional or technical fee. This means it’s not subject to the same tax regulations as income derived from professional services.

For example, consider an author who contributes an article to a journal. They might receive an honorarium as a way of acknowledging their contribution, but it’s not a fee for the writing services they provided. The payment is a thank you for sharing their knowledge and expertise.

It’s crucial to understand that honoraria are typically given voluntarily. The recipient is not obligated to accept it, and the payment is not tied to the completion of a specific task or service. This distinguishes it from a professional or technical fee, which is a payment for work performed and is typically negotiated upfront.

To clarify further, think about a professional who bills for their time and services. For instance, a doctor charging a fee for a consultation or a lawyer charging for legal representation. In these cases, the fee is a direct payment for the service provided.

However, when it comes to an honorarium, it’s a separate payment meant to express appreciation for the individual’s contribution. It’s not necessarily linked to the value of the service rendered, but rather, it’s a gesture of gratitude for their expertise and willingness to share their knowledge.

See more new information: bmxracingthailand.com

Gst On Honorarium Payments In India: What You Need To Know

So, you’re dealing with honorarium payments in India and you’re wondering about GST. It’s a common question, especially since the GST regime came into play. Let’s break down the intricacies of GST on honorarium payments, making sure you’re on the right side of the law.

What are Honorarium Payments?

First things first, let’s define honorarium payments. These are payments made for services rendered but not considered regular employment. Think of them as fees paid for specific tasks, projects, or contributions. Think of a speaker at a conference, a consultant working on a project, or an expert providing their opinion.

GST Applicability on Honorarium Payments

Now, the big question – when does GST apply to honorarium payments? It all depends on the nature of the service, the recipient of the payment, and the payer of the honorarium.

Here’s a breakdown:

If the service is taxable under GST, and the recipient is registered under GST, GST applies. This means if the service is categorized as a supply of goods or services under the GST Act, and the recipient is a registered taxpayer, GST is charged.

If the service is taxable under GST, but the recipient is not registered under GST, GST still applies. The payer needs to deduct TDS (Tax Deducted at Source) under GST at the applicable rate and pay it to the government.

If the service is not taxable under GST, GST does not apply. This means if the service is exempt from GST or falls outside the scope of GST, there’s no GST liability.

Identifying Taxable Services

Identifying taxable services under GST can sometimes be tricky. Here are some common examples:

Consultancy services: Providing professional advice or assistance on various matters.

Training services: Conducting workshops, seminars, or training programs.

Legal services: Offering legal advice or representation.

Accounting services: Providing accounting, auditing, or financial advisory services.

Software development services: Developing and supplying software applications.

Event management services: Organizing and managing events.

Writing services: Creating articles, blog posts, or other written content.

How GST is Calculated on Honorarium Payments

Let’s say the honorarium payment is ₹10,000, and the GST rate applicable is 18%. Here’s how you calculate GST:

GST amount = (18/100) * ₹10,000 = ₹1,800

Key Considerations for GST on Honorarium Payments

Threshold Limit: There’s a threshold limit for GST registration. If the recipient’s annual turnover exceeds this limit, they must register under GST.

Reverse Charge Mechanism: In some scenarios, the payer (the one making the honorarium payment) may be liable for GST under the reverse charge mechanism. This is typically applicable for services received from unregistered suppliers.

TDS Under GST: When the service is taxable and the recipient is unregistered, the payer has to deduct TDS under GST at the applicable rate.

Frequently Asked Questions (FAQs)

Q1. What if the honorarium payment is for a one-time service or a small amount? Does GST still apply?

A1. GST applies regardless of whether the service is one-time or a small amount. If the service falls under the taxable category, GST liability will arise.

Q2. Who is responsible for paying GST on honorarium payments?

A2. The responsibility for paying GST depends on the recipient’s GST registration status and the service itself. If the recipient is registered under GST, they are responsible for paying GST. If the recipient is not registered, the payer is responsible for deducting TDS under GST.

Q3. What are the consequences of not paying GST on honorarium payments?

A3. Failure to pay GST can lead to penalties and interest charges. You could also face legal action from the tax authorities.

Q4. What documentation is required for GST compliance on honorarium payments?

A4. You’ll need to maintain proper documentation, including invoices, payment receipts, and TDS certificates, to comply with GST regulations.

Q5. Where can I find more information about GST on honorarium payments?

A5. You can visit the official website of the Goods and Services Tax Network (GSTN) or consult a tax advisor for detailed information and guidance.

Conclusion

Navigating GST on honorarium payments can seem complex, but understanding the basic principles and the guidelines mentioned above can help you stay compliant. Remember, maintaining proper documentation and seeking expert advice whenever needed can ensure you are meeting all legal requirements.

This article provided information based on general understanding and is not a substitute for professional legal or tax advice. Always consult with a qualified professional for specific guidance and to ensure compliance with the latest tax laws and regulations.

Whether gst is applicable on honorarium payments ? – GST

Pankaj Rawat (GST Practitioner) (55047 Points) Replied 10 December 2018. Honorarium is not for any service rendered. Shouldn’t be applicable because the services rendered are originally without consideration and thus does not fall under supply. CAclubindia

Circular No. 177/09/2022-TRU ***** Room No. 146G, North Block,

Applicability of GST on payment of honorarium to the Guest Anchors; 10. Whether the additional toll fees collected in the form of higher toll charges from vehicles Goods & Service Tax, CBIC, Government of India

Clarification on applicability of GST rates, exemption, and …

GST on payment of honorarium to the guest anchors It is clarified that the supply of all goods and services is taxable unless exempt or declared as “neither a supply of goods Grant Thornton Bharat

Circular No. 160 16 2021 – Goods & Service Tax, CBIC,

Accordingly, it is clarified that: w.e.f. 01.01.2021, in case of debit notes, the date of issuance of debit note (not the date of underlying invoice) shall determine the relevant financial Goods & Service Tax, CBIC, Government of India

Honorarium vs Professional Fees, Income Tax – Tax

Articles invited are in a sense offer made and on publication of article, there is a contract.Therefore, to play safe tax may be deducted from honorarium, wherever Tax Management India

GST on honorarium payments to Guest Anchors- CBIC clarification

Some of the guest anchors have requested payment of GST @ 18% on the honorarium paid to them for such appearances. It is clarified that supply of all goods & TaxWink

GST payable on income earned from conducting Guest Lectures

Whether the income earned from Research and Training Projects funded by Ministries of Government of India and State Government of Karnataka, amounts to or Tax Guru

Clarifications regarding applicable GST rates … – Tax

Some of the guest anchors have requested payment of GST @ 18% on the honorarium paid to them for such appearances. 11.2 It is clarified that supply of all goods services are Tax Management India

India – Tax Authorities – CBIC Clarifies Applicability Of GST On …

The Central Board of Indirect Taxes and Customs (CBIC) has issued a circular dated 10 June 2020 (Circular), clarifying the applicability of goods and services Mondaq

Section 194J – Fees For Professional Or Technical Services

The types of payments to residents covered under this section are as follows: Fees for Professional fees. Fees for technical services. Remuneration or fees or ClearTax

White Goods \U0026 Their Gst In India | Gst On Tv, Ac | Gst News | N18S

How Much Gst Do You Have To Pay When Buying A Car | N18S | Cnbc Tv18

Taxation On Foreign Income In India

Income Tax On Foreign Income | Income Tax On Foreign Remittance | Tcs On Foreign Remittance

Gst On Advance Payment | Treatment Of Advance Payment Received Under Gst | Goods \U0026 Services Tax |

Save 51% On Any Car Using Taxation Laws Wisely!

विदेशी कमाई पर टैक्स टिप्स | Tax Guru | With Balwant Jain | Cnbc Awaaz

Suppliers Must Do This Before Issuing Credit Notes Or Giving Discount To Buyers| Gst New Circular

Gst On Advance Payment Received Entry In Tally Prime By The Accounts

Funds Received In Nre Account May Be Taxable – A Must Watch For Nris – Ca Sriram V Rao

Link to this article: gst on honorarium payments in india.

See more articles in the same category here: bmxracingthailand.com/what