What is gratuity in salary Malaysia?

In Malaysia, when you leave a job, whether by resignation or retirement, you might receive a lump sum payment known as gratuity. This is a way for your employer to recognize your long service and contributions to the company.

Think of it as a thank you for all the hard work you’ve put in over the years. Gratuity is usually paid when an employee has been with the company for a significant period.

Now, let’s dig a bit deeper into the nuts and bolts of gratuity in Malaysia.

Gratuity is considered a termination benefit, and it’s specifically tied to your past service to the company. This means it’s not part of your regular salary or wages, and it’s calculated based on a formula that usually considers your years of service and your final salary.

How Gratuity is Calculated

The exact formula used to calculate gratuity can vary depending on your employment contract and the company’s policies.

Here’s a typical calculation for gratuity:

Gratuity = (Years of Service x Final Salary x Rate)

The “Rate” can be a fixed percentage or a specific amount. For example, it might be 15% of your final salary for every year of service, or it could be a specific amount per year of service. This is usually spelled out in your employment contract.

Gratuity is generally considered taxable income in Malaysia. However, there may be some tax exemptions or deductions depending on your specific circumstances.

Understanding Your Rights

It’s important to understand the terms and conditions related to gratuity in your employment contract. This ensures you’re aware of your rights and what you can expect when you leave your job.

If you’re unsure about any aspect of gratuity or have questions, it’s always a good idea to consult with your Human Resources department or an employment lawyer. They can provide you with accurate information and guidance to help you understand your entitlements.

Is compensation taxable in Malaysia?

The Income Tax Act 1967 provides for two types of exemptions for compensation payments: full exemption and partial exemption. These exemptions are outlined in Schedule 6, paragraph 15 of the Act.

Full exemption is available for certain situations, such as:

Compensation for termination of employment due to redundancy or closure of the business.

Compensation for termination due to illness or disability.

Compensation for termination due to death.

Partial exemption is available for other situations where the compensation payment exceeds the maximum exemption amount. This means that only a portion of the compensation payment will be exempt from tax, while the remaining amount will be included in your assessable income.

The maximum exemption amount for partial exemption is determined based on several factors, including your years of service and your age.

Here’s a breakdown of the two types of exemptions:

Full Exemption:

Eligibility: Compensation for termination of employment due to redundancy, closure of the business, illness or disability, or death.

Tax Treatment: Entire compensation payment is exempt from tax.

Partial Exemption:

Eligibility: Compensation for other reasons beyond the scope of full exemption.

Tax Treatment: Portion of the compensation payment exceeding the maximum exemption amount is subject to tax.

To determine whether you are eligible for either type of exemption, you should consult with a tax advisor or refer to the Income Tax Act 1967.

It’s important to note that even if you are eligible for an exemption, you still need to declare the compensation payment in your tax return. You will also need to provide supporting documentation to substantiate your claim for the exemption.

Is 1 million enough to retire in Malaysia?

This number can be a good starting point, but it’s essential to consider other factors like your lifestyle, healthcare costs, and potential inflation.

Here’s a breakdown of things to consider:

Lifestyle: Do you plan to live modestly or have a more luxurious lifestyle? Consider your spending habits and how they might change in retirement.

Healthcare: Healthcare costs in Malaysia can vary depending on your health status and the type of treatment needed. Ensure you have a plan for managing these expenses.

Inflation: Prices tend to rise over time, which means your retirement income needs to keep up with inflation. Factor in a potential inflation rate when calculating your retirement needs.

While RM1 million might seem like a substantial sum, it’s crucial to remember that retirement is a long journey. A thorough analysis of your expenses, future needs, and potential income streams will help you determine if RM1 million is enough to support your desired lifestyle throughout your retirement years.

What is the basic formula for gratuity?

Gratuity = (15 × last drawn salary × working tenure) / 30

This formula helps you determine the gratuity you might receive based on your years of service with a company.

Last Drawn Salary: This refers to your final monthly salary before leaving your job.

Working Tenure: This is the total number of years you worked for the company. You can calculate this by subtracting your start date from your end date.

30: This represents the number of days in a month used for calculation purposes.

Example: If you worked for a company for seven years and your last drawn salary was $5,000, your gratuity would be calculated as follows:

Gratuity = (15 × $5,000 × 7) / 30 = $17,500

It’s important to note that this formula applies to companies that are covered under the Gratuity Act. If your company is not covered by the Act, then they may have their own gratuity policies that could differ from this standard formula.

Understanding the “15” in the Formula:

The “15” in the formula represents the number of days of salary you’re entitled to for each year of service. The gratuity calculation is based on the concept that you’re receiving 15 days’ worth of your last salary for each year you worked.

How the Gratuity Act Affects the Calculation:

The Gratuity Act sets a minimum gratuity amount that companies must pay to their employees upon retirement, resignation, or termination of employment. The Act also outlines the eligibility criteria for receiving gratuity.

Additional Considerations:

Minimum Period of Service: Some companies might have a minimum period of service requirement to be eligible for gratuity. This could range from a few months to a few years.

Maximum Limit: The Gratuity Act also sets a maximum limit on the gratuity amount that can be paid.

Other Factors: Additional factors, such as your performance review or any specific company policies, might also influence the calculation of your gratuity.

Understanding the gratuity formula and the associated regulations can help you better understand your potential financial benefits when leaving a job.

Is gratuity subject to EPF in Malaysia?

Service charge, overtime payment, and gratuity are not subject to EPF contributions.

It’s important to understand why. EPF contributions are designed to provide financial security for employees after they retire or leave their jobs. However, certain payments, like service charges, overtime pay, and gratuity, are considered non-recurring and not directly linked to an employee’s regular salary.

Think of it this way: gratuity is a one-time payment given to an employee for their long service to the company. It’s not part of their regular income, and it doesn’t affect their long-term financial security as much as their base salary does. Therefore, gratuity is excluded from EPF contributions.

The same logic applies to service charges and overtime payments. These are extra payments made on top of an employee’s regular salary, and they’re not considered part of their core income for EPF purposes.

This means that while your employer may pay you a gratuity, they don’t need to contribute to your EPF on that specific amount. Remember, though, that your regular salary is still subject to EPF contributions, and it’s essential to understand how EPF contributions work for your overall financial security in the long term.

Is leave encashment taxable in Malaysia?

Let’s break down the taxability of leave encashment:

What is leave encashment? Leave encashment is the payment you receive from your employer for unused leave days when you leave your job. This payment is essentially a cash equivalent of your accumulated leave days.

Why is leave encashment taxable? Leave encashment is considered taxable income because it represents an additional payment from your employer, similar to your salary or bonus.

How is leave encashment taxed? The tax rate applied to your leave encashment depends on your overall income for the tax year. Your employer will typically deduct taxes from your leave encashment payment based on your tax bracket.

Can leave encashment be exempt from tax? In certain situations, leave encashment might be exempt from tax. For example, if your leave encashment is paid due to a medical reason, it might be eligible for tax exemption. However, it’s essential to consult with your employer and tax advisor to confirm any exemptions that may apply in your specific case.

Important Note: Remember that tax regulations are constantly evolving, so it’s always advisable to seek professional tax advice to ensure you comply with the latest rules.

Are retirement benefits compulsory in Malaysia?

For non-residents and expatriates, contributing to the EPF is optional. This means that they can choose whether or not they want to contribute. However, if they do choose to contribute, they will be eligible for the same benefits as Malaysian citizens and permanent residents.

The EPF is a vital part of the Malaysian retirement system, and it helps to ensure that people have enough money to live comfortably after they retire. The contributions made to the EPF are invested in a variety of assets, such as stocks, bonds, and property, and the returns on these investments are used to pay out benefits to members.

There are a few different types of benefits that can be claimed from the EPF, including:

Retirement benefits: These are paid out to members when they reach the age of 55.

Death benefits: These are paid out to the beneficiaries of a member who dies before they reach the age of 55.

Disability benefits: These are paid out to members who become disabled before they reach the age of 55.

Housing benefits: These can be used to finance the purchase of a home.

The EPF is a well-run and financially sound scheme, and it provides a valuable safety net for Malaysian workers. It is important to note that the contributions made to the EPF are tax deductible for both employers and employees. This means that the amount of tax you pay is reduced by the amount of money you contribute to the EPF.

In summary,retirement benefits are compulsory in Malaysia for all citizens and permanent residents. This means that everyone who works in Malaysia is required to contribute to the EPF. This is a vital part of the retirement system in Malaysia and helps ensure that people have enough money to live comfortably after they retire.

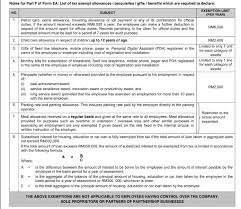

What is the tax exempt allowance in Malaysia?

Additionally, scholarships or similar grants given to individuals are also exempt from tax. This applies to individuals who receive financial assistance for their studies or training.

Let’s break down the tax exemption rules for travel, petrol, and toll expenses to give you a clearer picture.

* The RM6,000 allowance: This applies to all travel, petrol, and toll expenses used for official duties within a calendar year. You can claim this allowance even if you don’t have receipts for your expenses.

* Expenses exceeding RM6,000: If your expenses go over this limit, you’ll need to keep detailed records and receipts for each expense. This is crucial to support your claim for tax exemption.

* Official duties: This refers to any work-related activities required by your employer, such as attending meetings, visiting clients, or conducting site inspections.

* Keeping records and receipts: This includes maintaining a clear record of your travel dates, destinations, and the purpose of each trip. Receipts for petrol and toll payments should also be kept for seven years. You might consider using a dedicated expense tracking app or spreadsheet to keep your records organized.

By understanding these rules, you can make sure you’re maximizing your tax benefits and staying compliant with Malaysian tax regulations.

Is retirement income taxable in Malaysia?

This means that you won’t be required to file a tax return or pay any taxes on your pension or gratuity income. However, it’s always a good idea to check with the Inland Revenue Board of Malaysia (IRB) to confirm the latest regulations and ensure you’re in compliance.

The exemption applies to both public and private sector retirees. It’s an important benefit that helps retirees maintain their financial security and enjoy their retirement years with peace of mind.

Let’s delve a little deeper into the details of this exemption.

The tax exemption on pension and gratuity income for retirees is a significant benefit in Malaysia. This exemption is a way for the government to recognize the contributions of retirees and help them maintain their financial stability during their golden years.

However, there are certain conditions to be met in order to qualify for this exemption. For example, the pension or gratuity income must be derived from an approved retirement scheme. This means that the income should be a result of contributions made during the individual’s working years, rather than a separate lump sum payment.

Moreover, the exemption generally applies to income received from the pension or gratuity payments itself, not any additional income derived from investments or other sources.

It’s important to note that the exemption may be subject to change or modification based on future government policies. Therefore, retirees are advised to stay updated on the latest regulations and consult with the IRB for clarification or any specific queries they may have.

See more here: What Is Gratuity In Salary Malaysia? | Is Gratuity Taxable In Malaysia

Are gratuity and loss of employment taxed in Malaysia?

The Act states that gratuity is taxed under section 13 (1) (a) and loss of employment is taxed under section 13 (1) (e). However, both types of income have different tax exemption rules. The most recent revision of the Act was in 2013.

Let’s delve a bit deeper into these two types of income.

Gratuity is a payment that an employer makes to an employee upon the termination of their employment. This payment is usually calculated based on the employee’s length of service and salary. It’s important to note that gratuity is considered taxable income. However, the Income Tax Act 1967 allows for some exemptions for gratuity.

Loss of employment refers to the income received by an employee upon being laid off, retrenched, or dismissed from their job. This income includes severance pay, compensation, and any other benefits received due to the termination of employment. Similar to gratuity, loss of employment income is generally subject to taxation. However, there are specific tax exemption provisions related to this type of income as well.

It’s important to note that understanding the specific tax exemptions related to both gratuity and loss of employment is crucial. You should consult with a qualified tax professional in Malaysia to determine your tax liability based on your specific circumstances. They can provide you with tailored advice on how to maximize your tax benefits and ensure you comply with all relevant tax laws.

Is Gratuity taxable or compensation for loss of employment?

Compensation for loss of employment is paid to an employee when they’re let go from their job, and it’s usually intended to help them transition to a new position. It’s generally taxed as salary income in the year you receive it. This means it’s subject to regular income tax rates, just like your regular paycheck.

Think of it this way: gratuity is a reward for long service, often given at the end of a career. Severance pay, on the other hand, is a payment for a job loss and is a way to cushion the blow. This difference in the reason for the payment is what makes the tax treatment different.

There are a few things to keep in mind when it comes to severance pay:

It might be subject to additional taxes: Depending on where you live, severance pay may be subject to additional taxes, like state or local income tax, or even unemployment insurance. It’s always a good idea to check with your tax advisor or local tax authority for the specifics in your area.

It might be subject to withholding: Your employer might withhold taxes from your severance pay just like they do from your regular paycheck. But sometimes, they might not withhold anything, which means you’ll be responsible for paying the taxes yourself when you file your tax return.

It might be part of a settlement agreement: Sometimes, severance pay is part of a larger settlement agreement, like in cases of wrongful termination. These situations can get a bit more complex, so consulting with a tax professional is always a good idea.

It can be a bit confusing to figure out how all this fits together. But the bottom line is that severance pay is generally taxed as regular income. It’s good to know the basics and then, if you’re ever unsure, check with a tax professional for personalized advice!

Are loss of employment income taxable or exempted in Malaysia?

It’s important to understand that sometimes, the money you receive when losing your job can include compensation for loss of employment and gratuity. This is crucial because each component has different tax implications.

Compensation for loss of employment is a payment made by your former employer for the loss of your job. This is often calculated based on your salary, length of service, and the circumstances of your termination. Gratuity, on the other hand, is a discretionary payment often made as a thank you for your service to the company.

Here’s a breakdown of how each component is treated for tax purposes in Malaysia:

Compensation for loss of employment:

Taxable: Generally, compensation for loss of employment is taxable in Malaysia. However, there are some exceptions, such as when the compensation is paid due to an employer’s breach of contract or due to redundancy.

Exempt: In specific situations, this compensation can be exempt from taxation. For example, if your employer terminates your contract without a valid reason, you might be eligible for an exemption.

Gratuity:

Taxable: Gratuity payments are generally taxable in Malaysia.

Exempt: However, certain types of gratuity, such as those paid under a collective agreement, can be exempt from taxation.

To determine the tax treatment of your specific situation, it’s best to consult with a tax professional in Malaysia. They can help you navigate the specific rules and regulations applicable to your case.

Are Malaysians taxed on their total income?

Let’s break down how tax exemptions work in Malaysia. It all starts with your total income. This is the total amount of money you earned from all your sources throughout the year. But, not all of this income is considered chargeable income, which is the amount that actually gets taxed.

Here’s where the exemptions come in. They’re like deductions that reduce your chargeable income. This can save you money on taxes. For example, if you have children, you might be able to claim a tax exemption for their education expenses. The more tax exemptions you qualify for, the lower your chargeable income will be, and therefore, the less tax you’ll have to pay.

It’s important to keep in mind that the tax exemptions available vary depending on your individual circumstances, like your age, your marital status, and whether you have dependents. The government updates these exemptions regularly, so it’s a good idea to check the latest information from the Inland Revenue Board of Malaysia (IRB) to stay up-to-date.

See more new information: bmxracingthailand.com

Is Gratuity Taxable In Malaysia? A Guide For Employees

Alright, so you’re wondering about gratuity and taxes in Malaysia. It’s a common question, and it can get a bit confusing. Let’s break it down, shall we?

In short, gratuity is generally considered taxable income in Malaysia. But hold on, there are a few things to consider.

Here’s the thing: gratuity is basically a tip or bonus given to an employee for good service, and it’s often included in your salary. It’s important to know that income tax in Malaysia is based on your total income, which includes your salary, bonuses, and other income like gratuity.

The Inland Revenue Board (IRB), which is like the taxman in Malaysia, is responsible for making sure all your income is taxed correctly. So, your employer will usually deduct the tax from your gratuity before you even see it. They’ll report it all to the IRB.

Let’s Get Specific

Now, there are some exceptions. You might be saying, “Wait, what about gratuities from customers, like when I work in a restaurant?” Well, gratuities from customers are often treated differently.

Think about it this way: you’re usually a service worker and customers might choose to give you a tip or gratuity for good service. This type of gratuity is generally taxable in Malaysia, but the IRB has a bit of a different approach.

They’ll usually let you claim this gratuity as other income, and you can then report it on your tax return. The tax on gratuity from customers might be less than what you would pay if it was directly deducted by your employer.

Important Things to Remember

Here are some key points to keep in mind about gratuity and taxation in Malaysia:

Gratuity is usually part of your total income.

Employers usually deduct tax from gratuity before you get it.

Gratuities from customers are also generally taxable.

* You’ll usually need to declare gratuity from customers on your tax return.

Need Some Help?

If you’re still not sure about gratuity and taxes in Malaysia, the IRB has a ton of information on their website. You can also talk to a tax advisor or accountant if you need some personalized advice.

FAQs

Here are some common questions people ask about gratuity and taxes in Malaysia:

1. What if I get gratuity from a client for a specific project?

* Gratuity from a client for a specific project is considered other income. You’ll need to declare this income on your tax return.

2. Do I need to pay tax on gratuity from a customer if it’s less than a certain amount?

* No, there’s no specific amount of gratuity that’s tax-free. The IRB will consider the gratuity as other income regardless of the amount. However, you can deduct certain expenses related to earning the gratuity, which can reduce your taxable income.

3. How do I calculate the tax on gratuity?

* The tax on gratuity depends on your total income for the year. The IRB has tax tables that show the tax rates for different income levels. You can use these tables to calculate your tax liability.

4. Is there a specific form for reporting gratuity on my tax return?

* Yes, you need to fill out the Form BE (for individuals) and Form CP204 (for companies) to report your income and expenses, including any gratuity you received.

5. What happens if I don’t pay tax on gratuity?

* The IRB might impose penalties for failing to pay tax on your income, including fines and interest. So, it’s best to be compliant with the tax rules.

6. What if I’m working in a foreign country and receive gratuity from a Malaysian client?

* Gratuity from a Malaysian client while you’re working in a foreign country is still considered taxable income in Malaysia. You’ll need to declare this income on your tax return and pay the relevant tax.

7. Can I claim any deductions for gratuity received?

* You can usually deduct expenses related to earning the gratuity, such as travel expenses, accommodation expenses, and other expenses directly related to earning the gratuity. You’ll need to keep records of these expenses and provide documentation to the IRB.

Remember, staying compliant with the tax laws is crucial. If you’re unsure about any aspect of gratuity and taxation in Malaysia, it’s best to consult a tax advisor or accountant for personalized advice.

INLAND REVENUE BOARD OF MALAYSIA

(b) it is attributable to the past services of the employee (gratuity). The purpose of the lump sum payment has to be established in order to determine the tax treatment of the payment received by the employee. hasil.gov.my

Compensation for Loss of Employment in Malaysia –

Are the income received by these employees from loss of employment taxable or exempted in Malaysia? Before diving into the tax treatment, do note that in some circumstances sum received from loss thamconsultancy.com

Tax Treatment Of Compensation For Loss Of Employment

It is essential to determine whether the payment made to employee is in the nature of gratuity or compensation for loss of employment as different tax treatment is accorded YYC

Taxpayer Responsibilities | Lembaga Hasil Dalam Negeri Malaysia

The full amount of gratuity received by an employee on retirement from employment is exempt if: i. The Director General of Inland Revenue is satisfied that the retirement is Lembaga Hasil Dalam Negeri Malaysia

INLAND REVENUE BOARD OF MALAYSIA – Hasil

The lump sum of RM50,000 is considered to consist of an element of gratuity amounting to RM10,000 (as specified by the employer and calculated by reference to the employer’s hasil.gov.my

INLAND REVENUE BOARD MALAYSIA – Lembaga Hasil Dalam

Public Ruling as provided for under section 138A of the Income Tax Act 1967 is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Lembaga Hasil Dalam Negeri Malaysia

Loss of Employment? Is the compensation taxable?

Compensation for Loss of Employment. Lump sum payment is received due to the premature termination of employment which has the prospect of continuing up to the retirement age. (Taxed under Section 13 (1) (e) of Sdn Bhd

Tax Tips For Employees Who Lost Their Jobs Or Get

The lump sum payment may be described by the employer as compensation for loss of employment, ex-gratia, contractual payment, retrenchment payments or gratuity, etc. However, one should note that iMoney

Income Exempt from Tax – PwC

Retirement gratuity or termination payment other than gratuities which are fully exempted, up to an amount not exceeding RM1,000 per completed year of service. Royalties PwC

Malaysian Taxation 1 (Gratuity)

Income Tax On Gratuity | Tax Exemption

Whether Gratuity Taxable Or Not? Income Tax Calculation On Gratuity

What Is Gratuity? How Gratuity Works And Taxation | Gratuity Calculation

Income Tax Exemption On Gratuity| Circumstances When Gratuity Can Be Exempted From Tax| Enterslice

Gratuity Is Taxable Or Exempt Ii What Is Gratuity Ii Gratuity U/S 10(10) Ii #Cavedtaya

Gratuity From The Employer | Taxable Or Exempt!!? | Individuals | Income Tax | Section 10(10)

New Malaysian Income Tax: The Benefits

Malaysia Income Tax – Residence Status Of Individuals (马来西亚个人税务居民资格)

My Confirmed Income Tax Relief For Ya2024 Noa

Link to this article: is gratuity taxable in malaysia.

See more articles in the same category here: bmxracingthailand.com/what